Source: Cafef | https://cafef.vn/xay-dung-hoa-binh-rao-riet-thu-hoi-no-flc-da-tra-304-ty-sap-nhan-them-262-ty-dong-thang-kien-2-doi-tac-khac-188231013145214055.chn

Hoa Binh lost more than 700 billion VND due to the Matec sale not being recorded. It is expected that payment progress will be made in the third and fourth quarters of 2023.

Hoa Binh Construction Group (HBC) has just announced that the entrusted unit has completed collecting all debts from FLC Group Joint Stock Company (FLC) with an amount of more than 304 billion VND.

Specifically, ALB & Partners Law Firm informed that HBC and FLC had agreed to pay all debts related to the construction contract at FLC Sam Son eco-tourism urban area project of FLC in Quang Cu commune, Sam Son town, Thanh Hoa province.

As of 12 October 2023, HBC has recovered a total amount of more than 304 billion VND, including cash with a total amount of more than 270 billion VND, real estate at the FLC Sam Son eco-tourism urban area project was transferred to HBC to offset the remaining 34 billion VND debt.

In addition to recovering all debt from FLC, HBC also informed that they can collect a total of 262 billion VND in the near future if they win the lawsuits. Including:

First, Vietnam International Arbitration Center (VIAC) approved on HBC’s lawsuit request, forced Construction and Urban Development Joint Stock Company to pay HBC an amount of nearly 162 billion VND.

Second, People’s Court of Quy Nhon City, Binh Dinh province also approved on all of HBC’s lawsuit request and forced For Science Co., Ltd. to pay HBC an amount of more than 100 billion VND.

Winning the lawsuit and recovering debt is positive news in a context where contractors and Hoa Binh Construction is facing many difficulties. According to the 2023 semi-annual audited financial statements, the Company’s net loss is 711 billion VND. Meanwhile, in the self-made report, they reported a profit of 103.2 billion VND.

The biggest change item of Hoa Binh in the audited report compared to the self-made report is that other profits decreased by 99% to 6 billion VND. According to the explanation, this item changed due to a decrease in profit from the sale of assets of the parent company.

“The specific reason is that the sale of Matec has not been recorded, because the partner’s financial arrangements are not on schedule. We expect that the payment progress will be made in the third and fourth quarter of 2023”, HBC further responded.

In addition, Hoa Binh’s financial revenue also decreased by 76% after auditing, to 23.4 billion VND due to adjusting revenue from the transfer of subsidiaries…

Accumulated in the first 6 months of the year, Hoa Binh recorded net revenue of 3,462 billion VND, which has decreased nearly 52% over the same period last year. After deducting expenses, the Company reported a loss of 711 billion VND, while its profit was 64.7 billion VND in the same period last year.

According to the Resolution of the Board of Directors (BOD) dated 22nd of May regarding Hoa Binh’s debt recovery, Mr. Le Viet Hai, Chairman of the Board of Directors, said that 10 lawsuits out of 21 lawsuits regarding late payment have resulted in court judgements. All cases were tried and Hoa Binh Construction won. In which, the principal debt recorded in the accounting books is 829 billion VND, and the total amount of money that the defendant must pay to Hoa Binh according to the judgment is 1,223 billion VND, including late payment interest and additional costs, i.e. 47.5% higher.

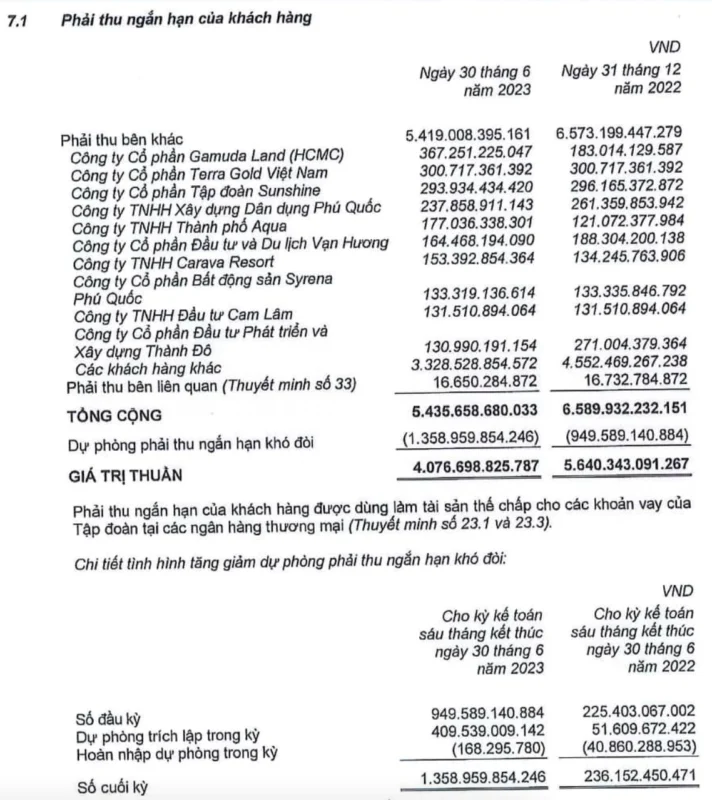

As of 30 June 2023, Hoa Binh’s short-term receivables were more than 9,091 billion VND, accounting for nearly 66% of total assets. Of which, more than 5,435 billion VND is receivable from clients, 3,782 billion VND is collected in accordance with the progress of construction contract plan. HBC also made a provision for short-term bad debts of nearly VND 2,480 billion, with 1,359 billion VND from clients, and nearly 474 billion VND in provisions for other receivables.

Another notable information is that, on 17th of October, Hoa Binh Construction will hold the second ad hoc General Meeting of Shareholders in 2023 to approve the plan of issuing a total of 274 million shares with an issue price of 12,000 VND per share and above, including private offer and private placement for debt swap. If the entire issuance is successful, the Company’s charter capital will increase from more than 2,741 billion VND to more than 5,481 billion VND.

Tri Tuc | Nhip Song Thi Truong

Some other articles about the above lawsuits:

- The Investor – Major builder Hoa Binh recovers $12.4 mln in debts from property developer FLC –

- VNExpress – Xây dựng Hòa Bình thu hồi hơn 300 tỷ đồng nợ từ FLC

- TheGioiTiepThi – DanViet – Hòa Bình đã thu hồi toàn bộ khoản nợ và lãi hơn 304 tỷ đồng từ FLC